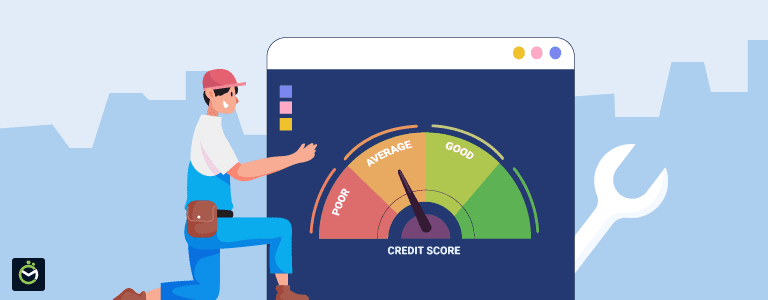

Your credit score is the determiner lenders use to decide if you are a qualified borrower when you need financing for any type of large purchase. Maintaining a decent credit score can be difficult, especially if you have made past financial mistakes. There are many things that impact your credit score. Here are three things to watch out for if you want to make sure you keep good credit.

1. Breaking a Lease

If you are leasing a house or a car, you sign a rental agreement dictating how much time you would use the item. Getting out of a lease early is possible, but you need to make sure you stay within the bounds of your rental agreement. If breaking the lease results in unpaid debt, it can have a negative impact on your credit score. This can follow you for many years and make it difficult for you to raise your credit and qualify for good interest rates on financing.

2. Accumulating Debt

Having a high debt-to-credit ratio is one of the worst things about your credit score. This calculation determines how much debt you have in contrast to the amount of credit you have. If you don’t have a lot of room on your credit cards, you probably have a high debt-to-credit ratio and need to take measures to improve it.

Paying down debt is difficult but not impossible. Break your debt down into manageable chunks and focus on paying off one credit card at a time. You may also need to make changes in your budget each month to pay on your credit cards the more you can pay over your monthly minimum, the faster you can get your debt under control.

3. Late Payments

If you make credit card payments late each month, it will negatively impact your credit score. Many credit cards offer grace periods, but if you consistently fail to make payments on time, you will have trouble maintaining your credit score. It’s best to pay on time each month, even if you can only afford the minimum payment.

Maintaining a good credit score is vital if you want to qualify for good interest rates on financing. Many factors determine your overall credit score, so it’s important to track your financial habits and set yourself up for good financial health. Watching out for these three things can help you maintain a good credit score.